The new system for registering electronic invoices (KSeF) aims to streamline the digital flow of documents. In the Ministry of Finance’s vision, the solution automates key processes in businesses. The use of KSeF will be mandatory for entrepreneurs in 2024, so it’s worth exploring this topic as soon as possible. How to authenticate in KSeF? What solution to choose for system identification? What benefits come from using structured invoices? You will find answers to these questions in this article.

- What is a structured e-invoice KSeF?

- What does the structured e-invoice in the KSeF contain?

- How does a structured KSeF e-invoice differ from a traditional invoice?

- Structured e-invoice in KSeF - when is it mandatory?

- Structured e-invoices in KSeF - benefits for taxpayers

- Structured e-invoice KSeF, Electronic Signature, and Seal

- What is the National e-Invoicing System

- Structured e-invoice KSeF - summary

What is a structured e-invoice KSeF?

A structured electronic invoice in the National e-Invoicing System (KSeF) is a document confirming the sale of goods or services, saved in XML format. It is a digital document compliant with prevailing regulations, replacing the traditional paper invoice. This means that the structured invoice exists solely in electronic form and adheres to the logical template imposed by the Ministry of Finance.

The structured invoice can be issued through the government’s “Aplikacja Podatnika” or externally, following the KSeF template. After filling in the fields and signing the document with an electronic signature or electronic seal, the invoice receives a unique identification number assigned by the KSeF system. In this form, it is available for download by the counterparty. To manage invoices, one can utilize either the free tool provided by the government or any commercial software.

What does the structured e-invoice in the KSeF contain?

A structured electronic invoice contains fields that the taxpayer fills in with relevant data. There are three types of fields:

- Mandatory fields: Filling in these fields is mandatory by law and includes data such as the seller’s VAT identification number (NIP), invoice issuance date, and invoice number.

- Optional fields: Filling in these fields is required only if the taxpayer completes other fields in a specific way (e.g., selecting the option for VAT exemption requires specifying the type of exemption).

- Voluntary fields: Filling in these fields is entirely optional and depends on the invoice issuer, such as additional description for the invoice or the place of issuance.

It’s worth noting that each structured electronic invoice sent through KSeF is automatically described with a KSeF number, facilitating its identification.

The template for a structured invoice is available in the Central Repository of Electronic Document Templates (CRWDE) on the ePUAP platform.

How does a structured KSeF e-invoice differ from a traditional invoice?

A structured invoice is a digital invoice that brings several benefits to the entire business. Primarily, it enables the generation of documents in XML format for the National e-Invoicing System (KSeF), as opposed to the traditional paper format. The introduction of a unified e-invoice standard accelerates data exchange between companies, promotes organizational digitization, and consequently, streamlines business transactions.

In contrast to a traditional invoice, a KSeF e-invoice is made available in real-time, positively impacting the automation of accounting processes. Structured electronic invoices are stored in the system for 10 years, counting from the end of the year in which they were issued. There is no need for additional archiving on company servers or in the cloud.

Compared to traditional documents, it’s worth noting that structured invoices cannot be lost or destroyed. KSeF users always have certainty that the invoice reached the customer or business partner, eliminating the need for issuing duplicates.

Structured e-invoice in KSeF – when is it mandatory?

Polish entrepreneurs can voluntarily use the KSeF system from January 1, 2022. During the transitional period, they can decide whether to issue structured invoices in KSeF or continue using the traditional paper or electronic forms as before.

Which entities are obligated to use KSeF? The mandatory implementation dates for KSeF are as follows:

- From July 1, 2024 – active VAT taxpayers,

- From January 1, 2025 – entities exempted both subjectively and objectively from VAT (non-VAT payers) concerning invoice issuance.

Structured e-invoices in KSeF – benefits for taxpayers

From July 1, 2024, using KSeF will be mandatory, so it’s worth exploring this system as early as possible. Firstly, it is advisable to familiarize the staff with the new tool before it becomes obligatory. Secondly, the system offers numerous conveniences that can streamline key processes in the organization.

Here are the key benefits associated with implementing electronic structured invoices:

- Standardization of invoice formats and ease of comparison,

- Facilitation of document circulation within the company,

- VAT refund within 40 days instead of 60 days,

- Faster, automated accounting that speeds up work,

- Fewer errors in accounting processes,

- No risk of losing invoices or overlooking emails with invoices,

- Reduced traditional documentation and paper savings,

- Increased purchasing opportunities within the European Union.

Structured e-invoice KSeF, Electronic Signature, and Seal

Electronic signatures are primarily chosen by individuals who make declarations on their own behalf or on behalf of the entity they represent. A qualified electronic seal ensures the integrity of corporate documents and identifies their origin. Its most significant advantage is that not only individuals but also legal entities, such as companies, organizations, and institutions, can use it. In this case, the structured invoice is signed only with the company’s data, without including the names of individuals representing it.

The full potential of this solution becomes particularly apparent when utilizing a cloud-based qualified electronic seal, dedicated to entities generating numerous invoices, placing special emphasis on online security.

These articles might interest you:

What is the National e-Invoicing System

The National e-Invoicing System (KSeF) is an IT software designed for entrepreneurs to issue and receive electronic structured invoices, which are exclusively in digital form. Within the KSeF system, the Taxpayer Application has been created. It enables the issuance, reception, and viewing of e-invoices, as well as the management of user permissions.

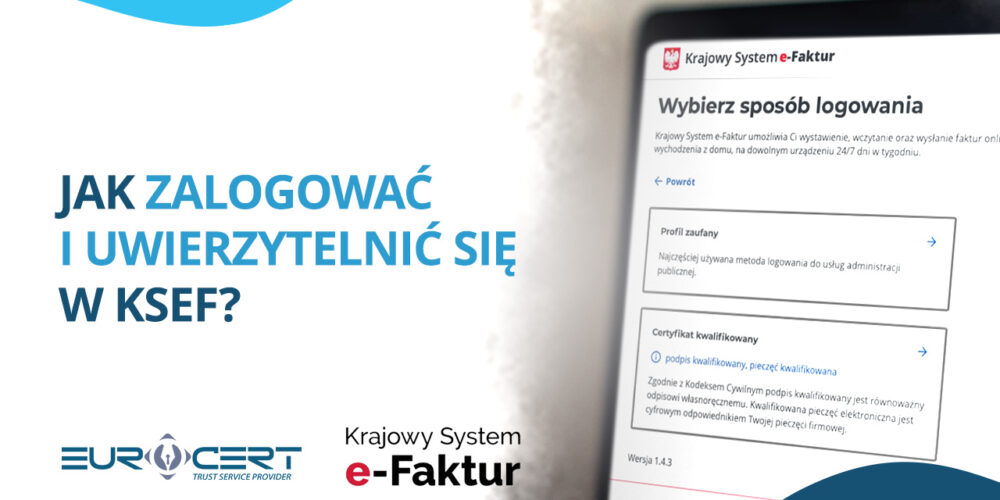

These actions become available only after prior user authentication, ensuring the authenticity, integrity, and security of transmitted documents. Authentication can be done through:

- Trusted Profile,

- KSeF token,

- Trusted services, i.e., qualified electronic signature or qualified electronic seal,

- ZAW-FA notification, submitted to the tax Poland office in case of the absence of PESEL and NIP in the qualified signature, along with unique identifying data (so-called signature fingerprint).”

These articles might interest you:

To fully benefit from KSeF, it is advisable to use a convenient electronic signature or electronic seal. The use of one of these tools is required right from the beginning, during user identification (authentication), allowing access to the system.

The universal, qualified electronic signature, or e-seal is useful in the daily operation of the Taxpayer Application, where each action requires separate identification. This includes issuing structured invoices, a new form of electronic invoice for taxpayers conducting business in the territory of the Republic of Poland.

Structured e-invoice KSeF – summary

The National e-Invoicing System will be mandatory for active VAT taxpayers from July 1, 2024. Since January 1, 2022, the Ministry of Finance allows voluntary use of the system, including issuing electronic structured invoices. Entrepreneurs who want to adequately prepare for handling KSeF and new legal regulations must use an electronic signature or electronic seal for identification in the Taxpayer Application. EuroCert provides various tools for qualified services, such as e-seals and e-signatures, and their types that can be easily tailored to the needs of small, medium, or large enterprises.

Are you interested in obtaining an electronic seal or e-signature? Contact EuroCert experts now, who will assist in choosing the optimal solution for your needs and answer any questions you may have.